Basic Buyer's Closing Costs Explanation Buying with a Mortgage

Closing costs for sellers and buyers have many variables: state, county, lender, title insurance company, contract sales price, broker, and more. Each and everyone has a different cost that has a variable and in that variable another variable. Please understand this is being provided as a courtesy and in no way should you hold Joe Ollis Real Estate & Auction, LLC or its agent liable when your costs or fees are different then the contents of this explanation.

We are only going to use the State of Illinois. If you are in another state know that each state and county has their own laws and customs. Any of these can be negotiated on the Contract for Sale of Real Estate to be paid by either the buyer or seller, we’ve organized it more traditionally who pays for what.

The following are some basic closing costs explained for the buyer getting a loan. Be AWARE that every single real estate transaction is different and no two are alike.

The contract sales price is what you are willing to pay for the real estate. Personal property negotiated into the real estate sales contract does not have a value, as the personal property becomes part of the real estate. If you want to buy other personal property not negotiated into the real estate contract it should be handled by a separate personal property contract or a bill of sale.

The closing fee is charged to coordinate the actual closing. The base closing can average $300. Customarily the fee is split 50/50 between buyer and seller. If the buyer is getting a loan the seller should not have to pay a closing fee IF the bank is doing the closing.

Lender’s title insurance is based upon the contract price and is charged so much per thousand. This price per thousand depends upon the company used. For our example, below we’ll use $2.50 per $1,000. The seller provides the buyer with an owner’s title insurance policy.

The title search cost is for the research on the buyers. Cost for the search will vary, with a minimum of around $350.00.

Title Examination fees start around $350.00 and go up. This is for review of the findings of the title search.

Title Insurance Binder is temporary title insurance expected soon to be replaced by a lender’s title insurance policy, cost about $25.00.

IL CPL is short for Illinois closing protection letter. The CPL is provided by the title company and is taxed by the State of Illinois, seller pays $50.00 and buyer pays $25.00 and lender fee of $25 which is paid by the borrower.

IL Title Reg is short for IL Title Regulation. The State of Illinois collects $3.00 for each policy written. The seller pays for the Owner’s Title Insurance Policy; the purchaser, if they are borrowing, pays for the Lender’s Title Insurance Policy.

The seller generally provides the buyer with a deed & PTax. The deed conveys the land from seller to buyer. The PTax record the price and amount of stamp taxes.

The seller gives the buyer a credit for real estate taxes. Illinois real estate taxes are paid in arrears, the 2015 taxes were paid in 2016 and the 2016 taxes are paid in 2017. Prorated real estate taxes are the previous year’s unpaid taxes and the current year up to the date of closing. The amount prorated generally comes from the current taxes. If the property is being changed somehow, the county assessor’s office can approximate the assessed property value and provide an amount.

Most properties being sold will not need a survey, because the legal description is not being changed. Surveys are necessary when changing the legal description of real property. The only people able to rewrite legal descriptions are surveyors. Survey costs vary greatly, as it depends what is being surveyed and how it is being divided. Most of the time sellers provide buyers with a survey, however sometimes the cost is split 50/50 between buyer and seller.

Home Inspections may be required by the bank and are a good idea. Houses are not perfect, even a brand new one. Home Inspections start around $500.00

An appraisal is a professional opinion or estimate of the value of the property. Appraisals start around $350.00.

Credit Report Fee is to run your credit on all three credit reporting companies, which is around $24.00

Flood Certification is to verify if the real property being purchased is in or out of the flood plain. Cost generally starts around $24.00.

Any known lien by the buyer should be resolved before starting the lending process. Liens against the buyer, found in the title search must be taken care of before closing or at the time of closing by the closing agent.

Your mortgage, deed, & PTax (given by the seller) will be recorded at the courthouse. To record anything at a county clerk’s office there is a fee, which is different in every county. Most have a flat fee for a specific number of pages and then a per page fee after the specific number is reached.

If you cannot be at closing, then everything can be mailed or emailed to you. Almost all the documents will need to be notarized and then overnighted back, by either UPS or FedEx, the closing company must have the originals. Courier fee start around $25.00.

Bringing Money to Closing: ILLINOIS LAW STATES

$50,000.00 & OVER – Funds are to be WIRED. Generally, the bank charges the title company around $25.00 and they in turn pass whatever their fee is on to you.

UNDER $50,000.00 – Funds are to be paid by CERTIFIED check.

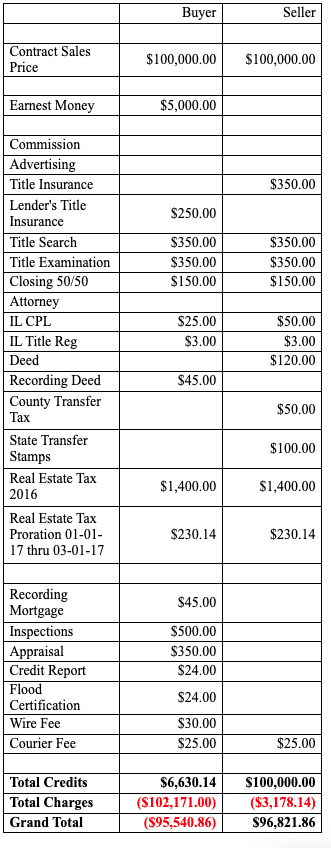

The following is NOT what a closing statement looks like, we are only providing this so you can see a visual of the numbers. Please remember almost all fees are not fixed, and we can help you with understanding this process.